Denver Real Estate Update July '25

Denver’s real estate vibe in summer 2025 is all about major market shifts—think more listings, subtle price changes, and new opportunities for both buyers and sellers. July kicked off with a noticeable jump in inventory; there are nearly 4,000 active residential listings in Denver, which is the highest July number the city’s seen in years. For comparison, there were just 1,380 homes on the market in July 2021. This inventory surge is giving buyers plenty of options and more negotiating power, while sellers are feeling the pressure to get creative and competitive.

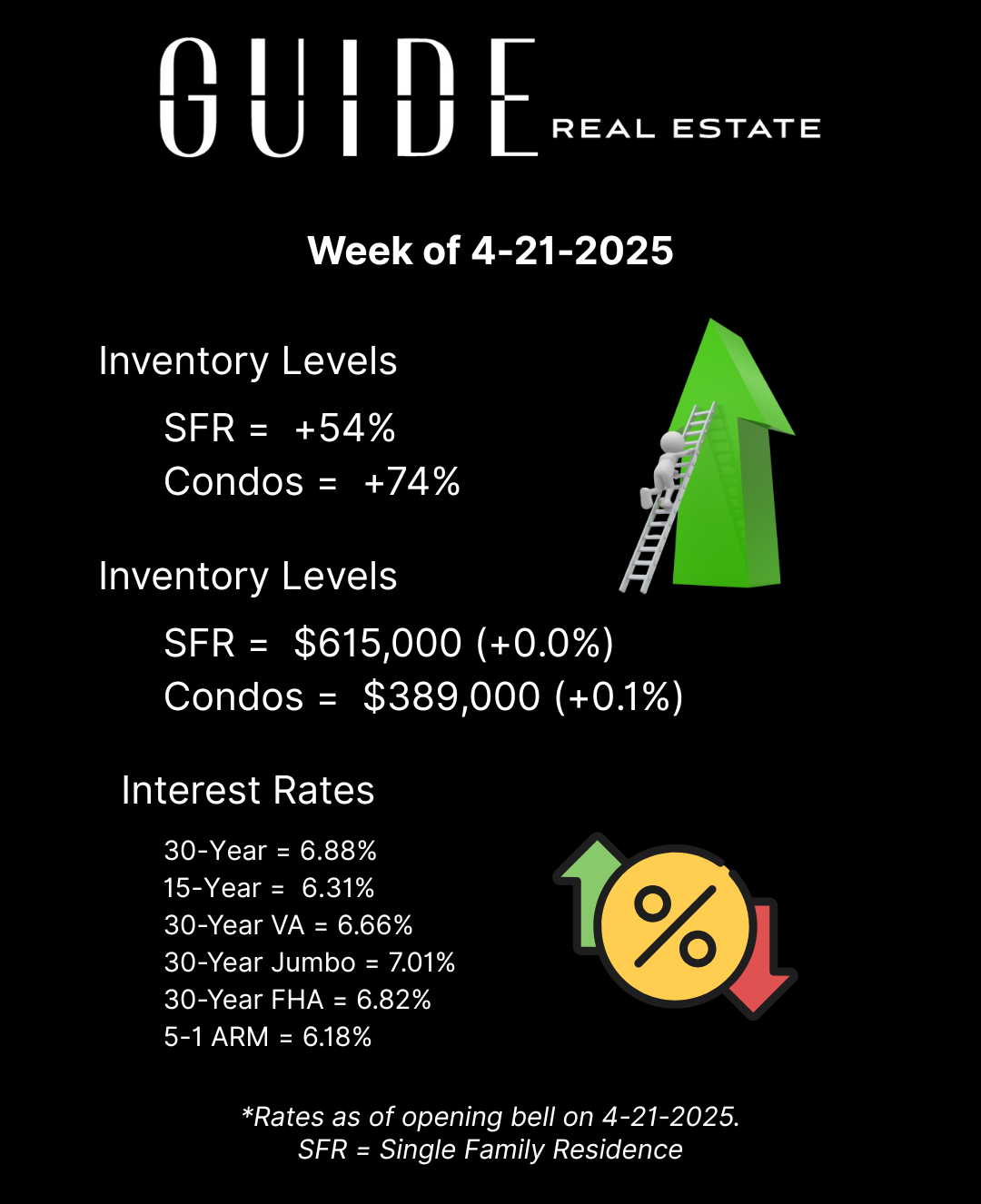

Pricing trends are interesting: while there’s a lot of talk about price cuts and homes lingering longer (46 days on average vs. 31 last July), the market is not “crashing”—in fact, the average sales price hovers around $684,000, down only 4% from a year ago, and the median is holding steady in the $600,000s. Many well-prepped, move-in-ready homes in popular neighborhoods are still drawing competitive offers and, after a smart price drop, sometimes even get bid back up close to their original asking price.

So, what’s driving these dynamics? Higher mortgage rates (around 6.8–6.9%) are dampening demand, causing buyers to take their time, which means homes spend longer on the market. But they’re also paving the way for a more balanced market—not a seller’s frenzy, not a buyer’s bonanza, but a chill, transitional phase. Year-over-year, buyers are still active, with closed and pending sales up about 5%, and Denver is actually outperforming the national home sales trend, which makes our scene feel a little more resilient—even as pricing flexes a bit.

Bottom line: If you’re shopping for a place, you’ll find more choices and less FOMO. For sellers, it’s all about smart pricing and putting your home’s best foot forward—today’s buyers are more deliberate and expect homes to stand out. This July, the Denver market is leveling up—think less hype, more strategy, and just enough unpredictability to keep local real estate fun (and maybe just a touch wild).